How to Spend Your Money On Healthcare

Posted by Jay on

Spending thousands of dollars a year on health insurance and healthcare needs a careful strategy. You wouldn’t buy a new car or a new house without doing your best to spend wisely.

Also, having insurance doesn’t mean you have doctors when you need them. In efforts to save money, insurance companies are limiting the number of doctors available to you. And without a doctor you can easily turn to at all times who can help you figure out exactly what you need, you’ll probably overspend. Many people go to the ER because they have nowhere else to turn to. Just one unnecessary $5,000 ER visit pays for 10 years of Sherpaa’s services. Healthcare is expensive but mistakes are avoidable. Having Sherpaa helps you figure out:

Can you get diagnosed and treated online or do you need in-person care?

Can you just get a blood or imaging test and get diagnosed instead of an in-person visit?

Do you need a specialist, an internist, an ER, or an urgent care visit?

Where can I get this medication for the lowest cost?

Can I get a refill on a medication without the cost of an office visit?

How to get the most out of your insurance

Step 1: Get a high deductible plan

Step 2: Get a Health Savings Account

Step 3: Get Sherpaa

Step 4: Spend on in-person healthcare strategically and only when necessary

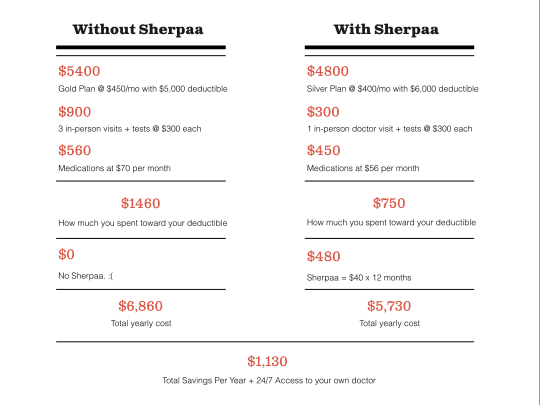

$1,130: Typical Savings Per Year as an Individual with Sherpaa

The Details

Sherpaa wants to ensure you spend as little of your deductible as possible. Our unlimited care membership covers the costs of treating 70% of typical primary and urgent care health issues, avoiding out-of-pocket spending on expensive in-person visits and tests. For the 30% of the time that you need in-person care, Sherpaa doctors organize in-network care for you helping you spend effectively. Most insurance plans make you spend thousands before insurance starts picking up the bills. Sherpaa is a smart layer that sits on top of any health insurance plan and helps you spend your money wisely.

Here’s how to do it:

Step 1: Choose a high deductible plan.

Use your employer, healthcare.gov, or Stride.

A higher deductible means a lower monthly premium (the typical difference is ~$50 less per month for an individual).

We recommend choosing the insurance plan with lowest monthly premium. This works best for most people.

Step 2: Get an FSA or HSA account

As an individual, you can invest $3400 pre-tax dollars per year into the FSA or HSA account (What is an HSA account?) that can be spent on healthcare, including Sherpaa. This means Sherpaa’s $40 a month fees are discounted by ~20% (pre-tax money) turning that $480 a year into ~$380 for unlimited 24/7 care.

You can get these accounts through your employer or as an individual through your bank (Bank of America, Wells Fargo, UMB, etc).

You can also invest the money in your HSA account in a service like Betterment and likely earn a return on your investment. The average return on Sherpaa’s employees’ Betterment accounts was 8% for the past year.

Step 3: Join Sherpaa: Get 24/7 doctors + financial guidance

Figuring out what you need and how much to spend is almost impossible. We’re doctors who know how to look after your health and wallet.

If you switch insurance companies, you often switch your traditional PCP. Instead, use Sherpaa as your PCP and don’t ever worry about which plan you have.

Just remember

Sherpaa never bills you for anything but our monthly membership fee. It’s unlimited 24/7 care.

If any doctor, including a Sherpaa doctor, orders tests or medications before you’ve spent your deductible, you cover the costs. If you’ve spent your entire deductible, insurance picks up the costs.

Assumptions

Average 18-65 year old has 2.8 doctor, ER, and urgent care visits per year

Sherpaa prevents 2 out of 3 in-person visits

Working age population gets, on average, 8 prescriptions a year at an average cost of $70 a month. Sherpaa doctors prescribe medications through the app and direct you to the most cost-effective way of getting these medications.

Get Writing in your inbox